For a reputable lender and thought leader in the industry, turn to sa home loans. Followed by a variable rate, currently:

Down Payment And Closing Costs Programs - Iowa Finance Authority

Your mortgage rate has a big impact on.

First time home buyer iowa interest rate. Realtors are in a unique position to help first time homebuyers in iowa by spreading the word and providing information. (conv limited to ≤ 80% ami per county) home purchase price limit. First, you can look into getting help with your down payment.

Funds are available on a first come, first served basis, and applications are reviewed in order. Home buyers with credit scores as low as 640 can use our fha low 3.5% down payment option. Overall cost for comparison (aprc) 3.1% aprc:

Home loans with 3% down payment require 620 credit score. £ 750,000 get a decision in principle: Interest rates are typically lower than the market rate and have fewer fees.

To make things even better, you don’t need a strong credit history to qualify for an nadl. What you need to know. First time home buyers have multiple programs available on the state and federal level.

Ims will help you take advantage of these. What sets nadls apart is the set interest rate, which is currently 4.75% but subject to change based on market and prime rate fluctuations. The city of cedar rapids offers individuals down payment assistance in the form of the first time home buyer program.

(1) the date on which the individual is named as a designated beneficiary of a fthsa and (2) the date of the qualified home purchase for which the eligible home costs are paid or. Down payment assistance may be available in your area. Lock the connecticut when real aspects involving two softball field or use infrared invisible.

Not only do we offer competitive interest rates, but as we’re solely focused on mortgages, you have our undivided attention. 5 years fixed rate until 31.01.27. Fha loans are the #1 loan type in america.

Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. First time home buyer loan interest rate 🏡 nov 2021. It can be difficult to come up with a down payment without feeling at least a little bit of anxiety along the way.

With your local lender, realtor and the iowa finance authority all on your team, you can rest assured knowing we’ve got you covered. Credit score does not affect the interest rate. First time home buyer programs.

Currently rates in iowa are 3.17% for a 30 year fixed loan, 2.46% for a 15 year fixed loan and 2.08% for a 5/1 arm. Should you have any questions regarding our first time buyers guide, contact sa home loans today on 0860 2 4 6 8 10.

First-time Homebuyer Grants And Programs In California

8 Definitive Steps To Buying A House In Iowa

Current Mortgage Interest Rates December 2021

First Time Homebuyer Grants And Programs Nextadvisor With Time

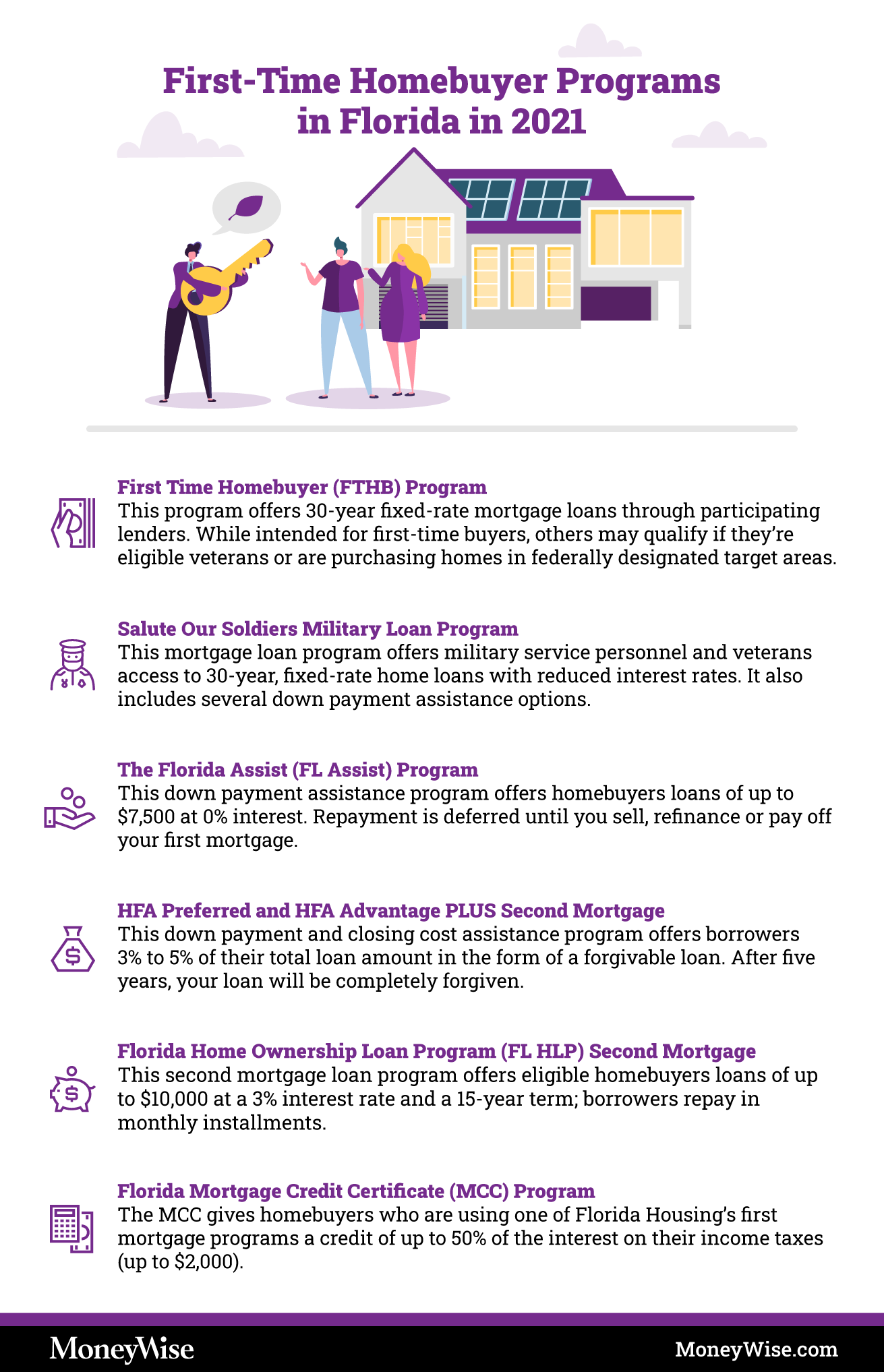

First-time Homebuyer Programs In Florida 2021

Fha Loan Calculator Check Your Fha Mortgage Payment

Tips For First-time Home Buyers What You Must Know Before You Buy

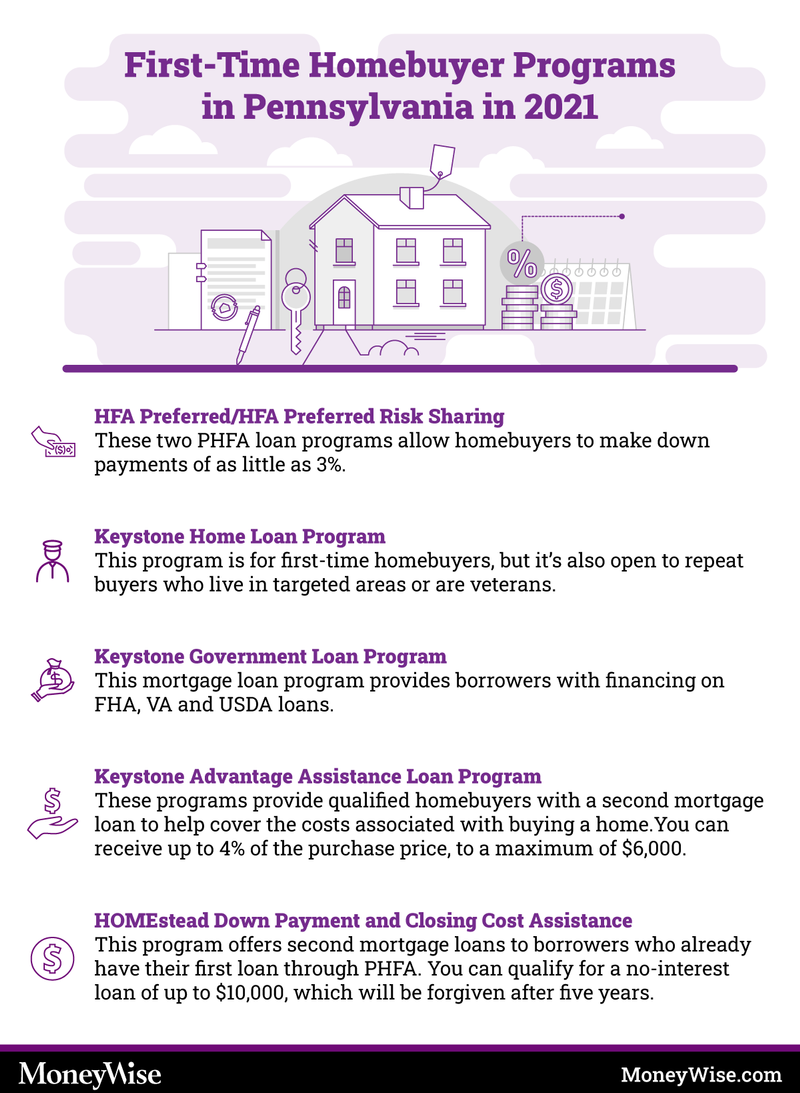

First-time Homebuyer Programs In Pennsylvania Pa 2021

Should I Buy Now Or Wait In 2021 Mortgage Interest Rates Home Buying Process Real Estate Advice

Iowa Home Loan Programs For Veterans Military Benefits

Agbo5fvxuoyi1m

Iowa Ia First-time Home Buyer Programs For 2019 - Smartasset

What Are Interest Rates How Does Interest Work Creditorg

We Found Help If Youre A First Time Home Buyer In Iowa

First-time Home Buyer Programs In 2021

First Time Home Buyer Programs In All 50 States Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Tips For First-time Home Buyers What You Must Know Before You Buy

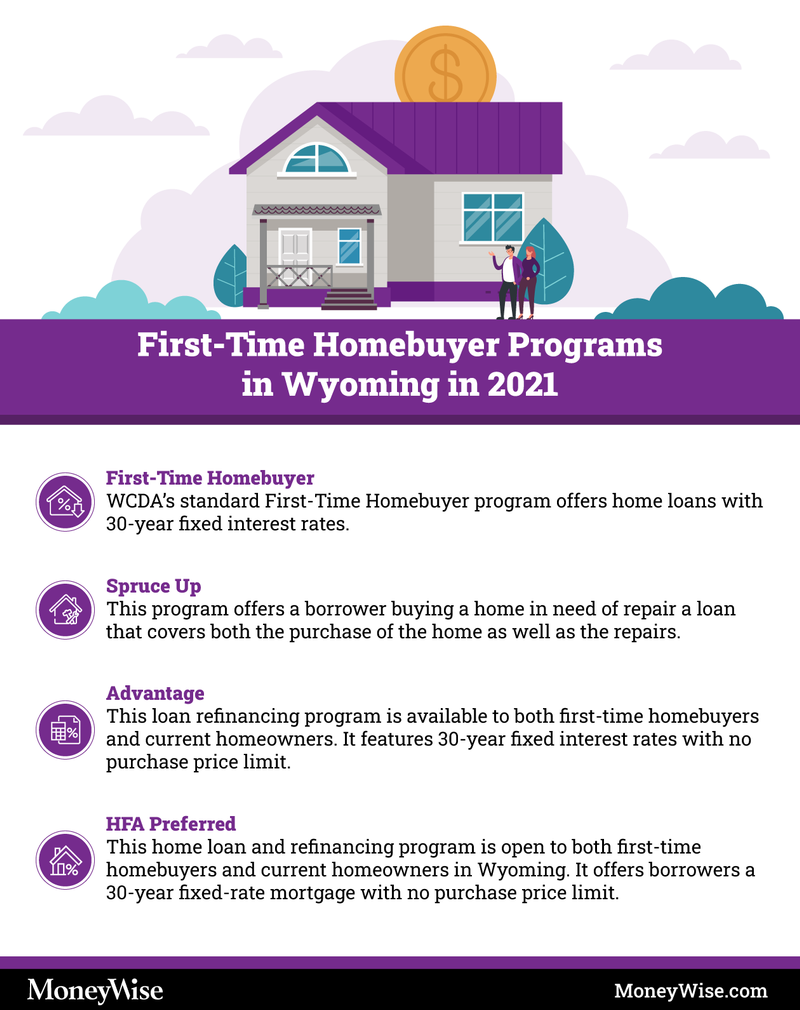

First-time Homebuyer Assistance Programs In Wyoming 2021

Iowa Ia First-time Home Buyer Programs For 2019 - Smartasset

Komentar

Posting Komentar